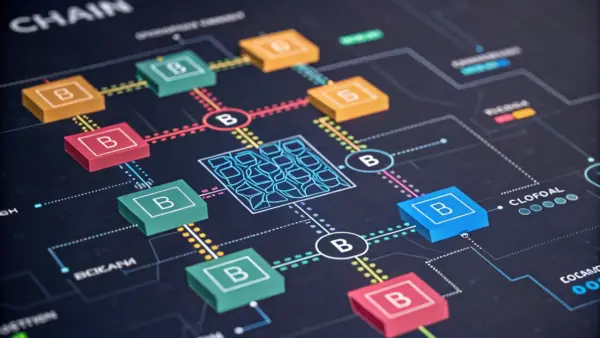

Blockchain technology is rapidly changing the way we think about finance and transactions. Its decentralized nature offers significant advantages over traditional systems. This article explores the core principles of blockchain technology and its potential impact on various financial sectors. Understanding the technology is crucial for navigating the future of finance. The decentralized nature of blockchain allows for secure and transparent transactions. This eliminates the need for intermediaries, reducing costs and increasing efficiency. Furthermore, the immutability of blockchain records enhances trust and security. These features are revolutionizing various industries, from supply chain management to digital identity. Despite its potential, blockchain technology faces challenges. Scalability issues and regulatory uncertainties are key concerns. Furthermore, the complexity of the technology can be a barrier to widespread adoption. However, ongoing research and development are addressing these challenges, paving the way for broader implementation.

Bitcoin Coalition Pushes Back Against MSCI Proposal Targeting Bitcoin-Heavy Companies

Bitcoin For Corporations (BFC) challenged MSCI’s plan to exclude companies with over 50% of assets